Leasing takes different types which are given below. Types of the Lease.

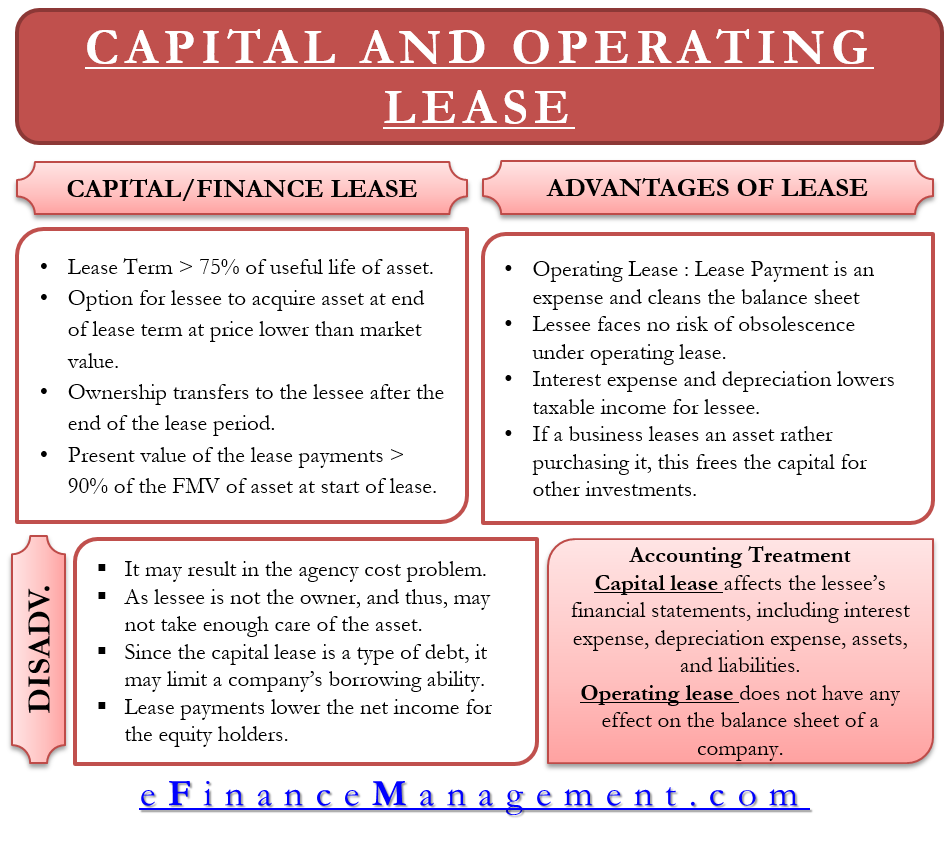

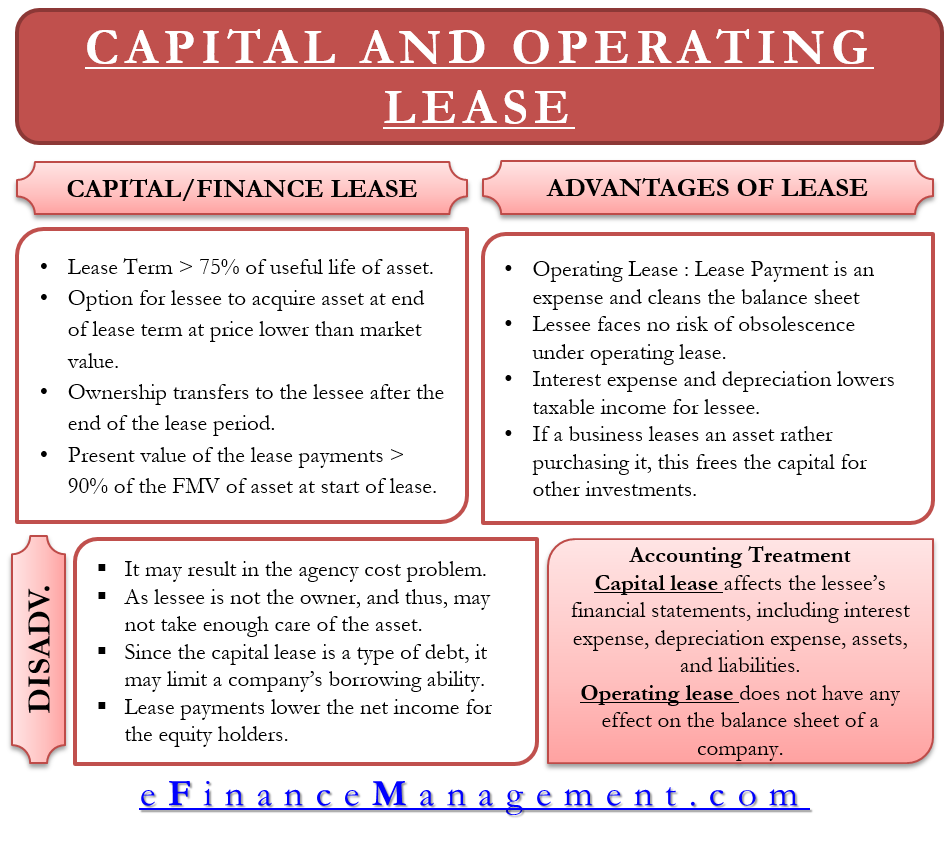

Advantages And Disadvantages Of Leasing Lease Financial Strategies Economics Lessons

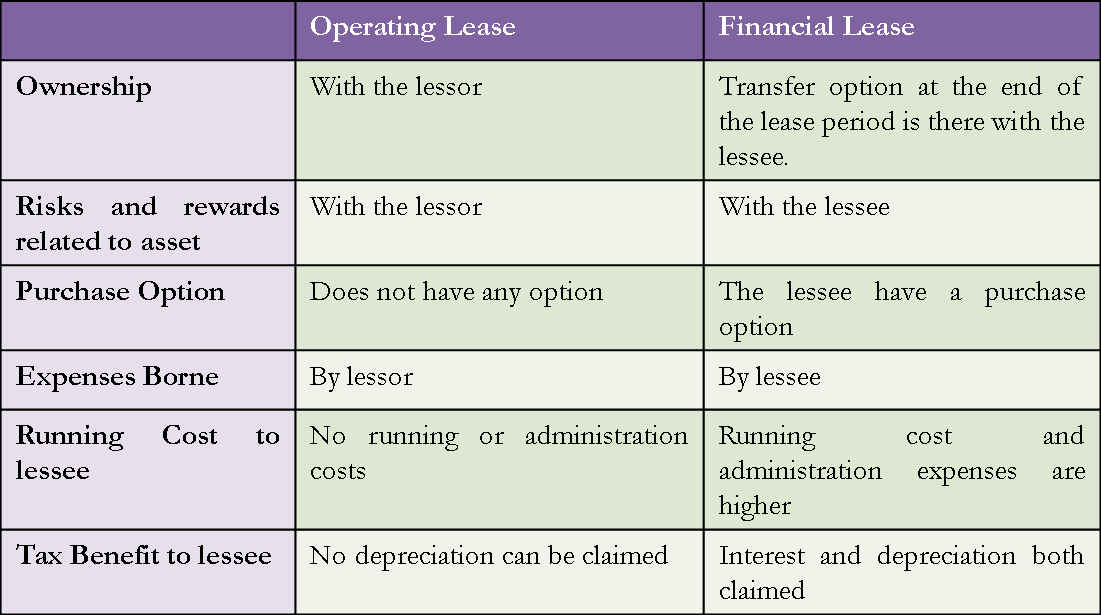

Some of the main differences between a finance lease and an operating lease are.

. This type of lease which is for a long period provides for the use of asset during the primary lease. A finance or capital lease is equivalent to a lessees purchase of an asset that is directly financed by the lessor. It may have the option of balloonresidual payment so that.

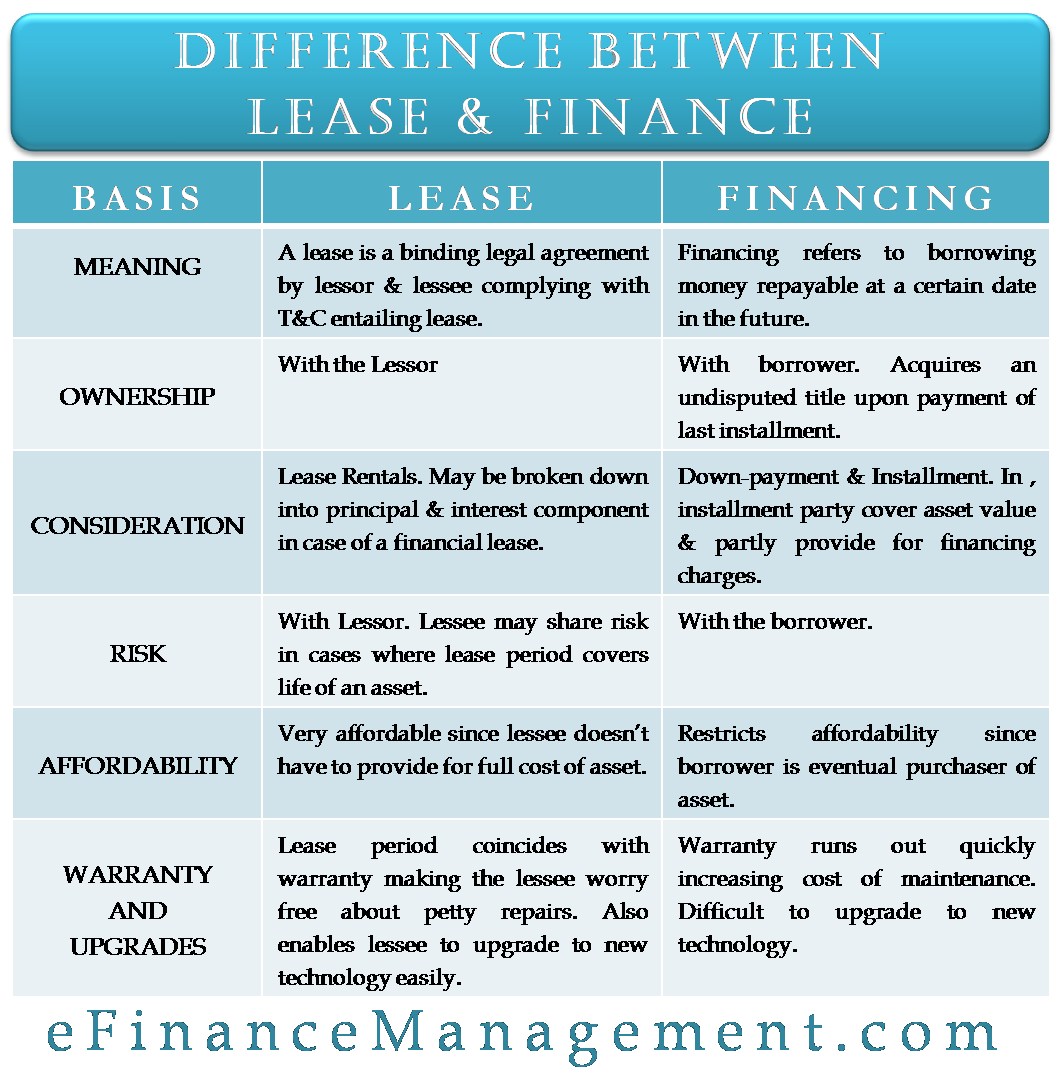

Leases are contracts in which the propertyasset owner allows another party to use the propertyasset in exchange for something usually money or other assets. Triple Net Lease NNN Rent utilities proportionate share of building operating expenses eg. The two most common types of leases.

It is a long-term lease and. In a finance lease ownership of the asset is transferred to the lessee after the expiry of the lease term. Based on the Method of Lease.

The classification is based on the extent to which the risk and rewards incidental to the ownership of the leased asset lie with the lessor or the lessee. Financial leasing is a contract involving payment over a longer period. The lessee pays only the monthly lease payment in an operating lease.

Each type has their own set of rules and regulations and can be used for multiple different occasions. Operatingfinancial and combination CITATION Gap15. Explain how they would benefit managers for financial planning.

Subsequently it requires the lessee of the asset to accommodate for relevant changes in Income Statement and Balance Sheet just as if it was they were the property of the user of the asset. These types of lease financing are also known as Capital Lease. A financial lease involves the ownership rights of the asset being transferred to the user of the asset at the end of the lease period.

Here the lessor refers to the original asset owner while the lessee refers to the party using the asset in lieu of lease. A lease is a type of transaction undertaken by a company to have the right to use an. The lease agreement is fully amortized in Financial Lease which means that the lessor gets the principal amount of the asset as well as the profit of his investment in such.

In response to your peers discuss the additional advantagesdisadvantages that your peers. Very popularly heard leases are financial and operating leases. Explain how they would benefit managers for financial planning.

There are three major types of leases operating financing and combination leases. This is also called financial lease. Contrary to capital lease the period of operating lease is shorter and it.

According to our text there are 3 informal classifications of leases. An operating lease on the other hand is an agreement that allows a lessee to use an asset for a period of time. But in the operating lease agreement the ownership of the asset always stays with the lessor.

The lease period usually covers the entire economic life of the asset. In an operating lease the lessee uses the asset for a specific period. This problem has been solved.

Select one lease option and describe the advantages anddisadvantages of selecting that option in your role as manager. Lease Financing Describe the different types of leases. The rest of the operating expenses if applicable 3 types of net leases.

Explain how they would benefit managers for financial planning. Lease Classifications Lease classifications include operating leases and capital leases. The economic substance of a finance lease is very different from that of an operating lease.

Select one lease option and describe the advantages and disadvantages of selecting that option in your role as manager. Select one lease option and describe the advantages and disadvantages of selecting that option in your role as manager. Full pay out lease A Full Payout Lease covers the total valuecost of the asset through Lease rentals and scrap value.

The lessor bears the risk of. A financial lease is a lease where rewards and risk associated with the leased asset gets transferred to the lessee with a transfer of the asset while in operating risk risk and return remain with the lessor. Leases are classified into different types based on the variation in the elements of a lease.

Describe the different types of leases. Finance lease and operating lease are the different accounting methods for the lease where in case of Finance lease all the risk and rewards related to the asset under consideration gets transferred to lessee whereas in case of Operating lease all the risk and rewards related to the asset under consideration stays with the lessor. Currently in the United States it is estimated that 35-40 of all.

Finance and Operating Lease. Explain how they would benefit managers for financial planning. A capital lease is a long-term arrangement which is.

Select one lease option and describe the advantages and disadvantages of selecting that option in your role as manager. Financial Lease may be of two types. 4 Types of Lease Financing Explained.

Apart from these there are the sale and leaseback and direct lease single investor lease and leveraged lease and domestic and international lease. A Financial lease is also referred to as Capital Lease. Ad Get ALease Agreement Using Our Simple Step-By-Step Process.

Consequently the tax and accounting aspects of lease transactions are different from that of other financing plans. Describe the different types of leases. Answer Simple Questions to Make A Lease Agreement On Any Device In Minutes.

In a financial lease the lessee bears the cost of insurance maintenance and taxes. Maintenance fees insurance property taxes Base building maintenance and repairs. The Most famous kind of leasing especially in Asian region of the world.

The lease term extends to less than 75 of the projected useful life of the leased asset. It is where the asset is not wholly amortized during the non-cancellable period if. Difference Between Financial Lease vs Operating Lease.

Following are the main characteristics of Financial Lease. The lease term is generally the substantial economic life of the asset leased. Essentially opposite of gross lease.

Difference Between Operating Versus Financial Capital Lease Efm

Lease Definition Features Advantages Disadvantages Types

Leased Asset Types Accounting Treatment And More

Difference Between Lease And Finance Ownership Risk Consideration

0 Comments